IG Private Wealth Management | Jeff Somers & Associates

Understanding the real returns from “safe” investments

By IG Wealth Management

Many investors like to fill the bulk of their portfolio with so-called “safe” investments, often for a variety of reasons. They may have an innate distrust or fear of the markets; their key goal is to maintain their savings’ value; they’re in or about to enter retirement and don’t want to risk losing any of their savings; or recent market volatility has spooked them.

While “safe” investments will typically prevent investors from losing any of their capital, there’s a pervading myth that safe investments can also grow your money.

In this article, we’ll explore the more popular kinds of perceived safe investments, how, in many instances, they can reduce the value of your savings rather than grow them, and alternatives to safe investments that can help grow your money over the long term.

What is a safe investment?

There is some debate as to what constitutes a safe investment, given that some ways of saving money aren’t technically investments. A savings account, whether it’s “high interest” or not isn’t typically considered an investment. Let’s take a look at what are generally considered to be safe investments and how they work.

Guaranteed investment certificates (GICs): these are a very safe option, given that they’re usually issued by banks or credit unions, with the amount you invest guaranteed by the Canadian Deposit Insurance Corporation or provincial deposit insurance. You typically need to lock in your money for a fixed period of time, however, and may have to pay penalties if you need to withdraw your money early. Interest is usually higher than savings accounts but still lower than most other forms of investment.

Treasury bills (T-bills): these are effectively loans to the Canadian government. In return, investors are paid interest. The interest is the difference between the face value (what you’ll collect at the end of the term) and the discounted price (what you pay for it). Given that these are issued by the Canadian government, they are considered extremely safe investments.

Government bonds: when governments (federal, provincial and municipal) need to raise money, they often issue bonds. These have a guaranteed payment of both the principal (the amount invested) and the promised fixed rate of return. Given that these bonds are backed by governments, they’re considered very low risk, especially when compared to corporate bonds and securities (shares in companies).

Safe investments’ fatal flaw: inflation

It is a universal truth in investing that, typically, the lower the risk, the lower the reward, and the higher the risk, the greater the return potential. This is the problem with “safe” investments; they’re only safe insofar as you’re highly unlikely to lose your money (or even a large chunk of it).

The danger comes when you consider your savings’ buying power. Your money needs to grow by at least the rate of inflation to maintain its buying power from one year to the next. If your investments don’t keep up with inflation, they effectively lose some of their value.

Let’s take the example of 2022: over the course of that year, inflation in Canada was at an average level of 6.8%. However, over the course of that year, the average returns from safe investments came in considerably lower:

- GICs had an average return of around 2%.

- The Canada 3-month Treasury Bill yield was 2.82%.

- Long-term real-return bonds peaked at 1.75%.

- Long-term Government of Canada benchmark bond yields peaked at 3.68%.

Depending on which safe investments you held in 2022, your savings could have lost as much as 4.8% of their real value.

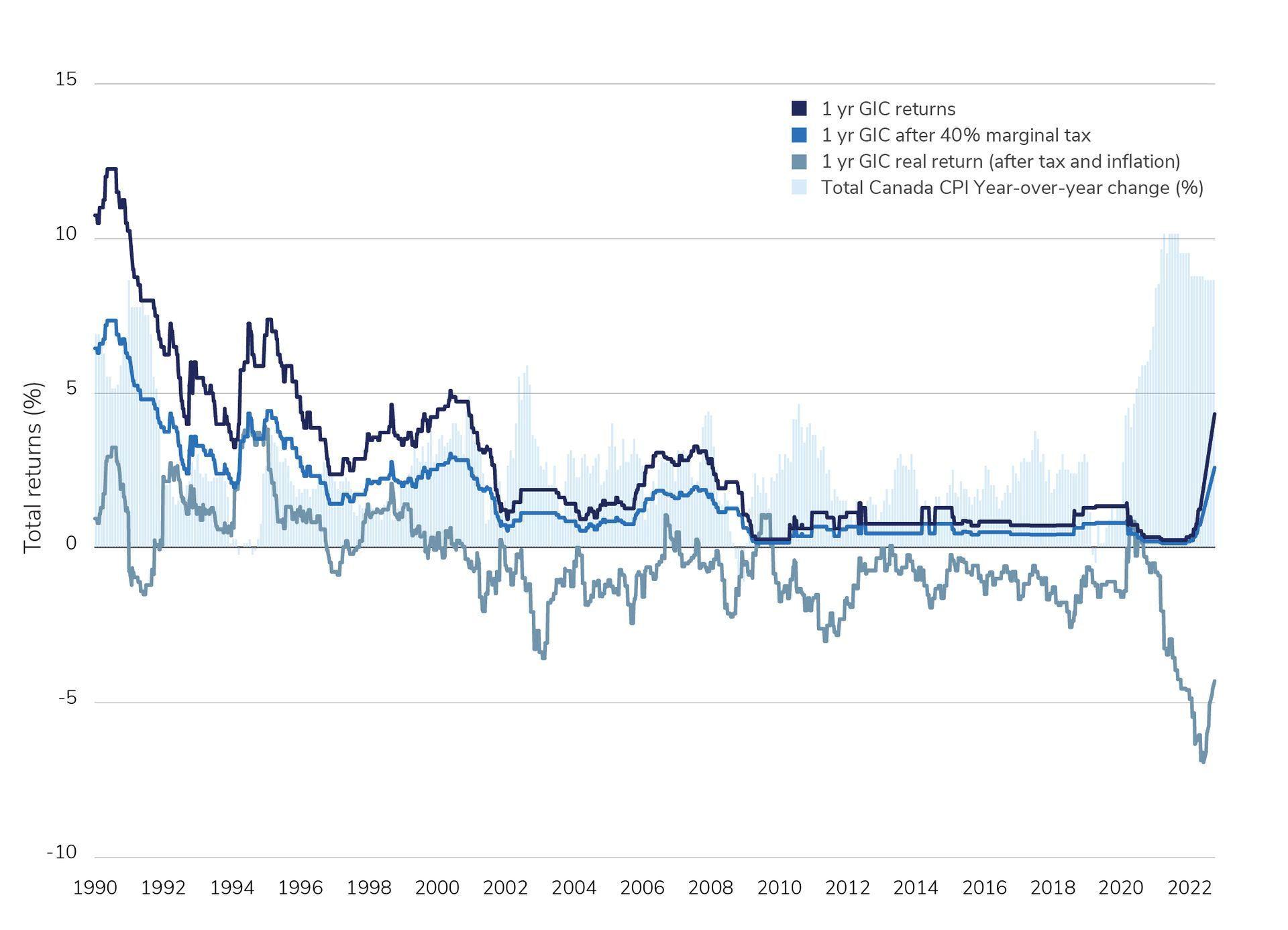

If we focus on GICs, for the last 20 years or so, if you factor in inflation and tax (if your GICs are held in a non-registered account, income you receive from them will be taxed at the highest marginal tax rate) returns from GICs were either negligible or negative (your money would have lost value). Clearly, keeping all your money in safe investments is not a wise strategy, no matter what stage of your life.

GIC returns: 1990-2022

Given that investors typically can’t afford for their savings to lose value, how can their investments make sufficient gains to overcome the effects of inflation, without taking on undue risk? Let’s take a look.

Alternatives to investing only in “safe” investments

As with any investment portfolio, diversification is key to minimizing risk while sufficiently growing your savings so that your money maintains (or exceeds) its buying power. Also, there are several types of investments that, while not as safe as those mentioned above, are designed to be less impacted when the stock markets fall.

Investment grade and high yield bonds: unlike the government bonds mentioned earlier, these bonds are issued by companies and therefore typically offer better rates of return. Investment grade bonds usually have a “BBB-” rating or higher, meaning they are among the less risky of corporate bonds. High yield bonds have a rating below “BBB-”, so while they’re riskier, they usually provide a higher return.

Preferred shares: these are often called hybrid securities, because they nestle somewhere between a bond and regular stock (shares in a company). Preferred shareholders usually enjoy better returns than bond holders, but get paid out before regular stockholders if the company goes under.

Low-risk stocks: not all companies are high-risk investments. Companies that are in stable industry sectors and which pay out consistent, sustainable dividends, can be a good option for risk-averse investors. Known as dividend stocks, these investments can capture most of the gains of the overall stock market and less of the losses.

As an example of how dividend stocks perform, let’s look at the S&P 500 Dividend Aristocrats Index. This index is made up of a selection of companies chosen from the S&P 500 (the biggest companies in the U.S.) that are worth over $3 billion and that have increased their dividends consistently over the last 25 years. In 2022, when the S&P 500 as a whole lost around 18% of its value, the Dividend Aristocrats only fell by 9% — a huge difference. Also, investing in this group of companies means that you’re getting consistent income in the form of dividends, which in turn boosts your money’s buying power.

Alternative investments: there is an increasing number of sophisticated alternative investments becoming available to individual investors. Previously available only to large, institutional investors, assets such as private credit (loans to privately owned companies) and private infrastructure can provide returns that have little relation to the ups and downs of the stock market.

What are the best safe investments for you?

You IG Advisor will be able to provide recommendations for safer investment options that are designed to ensure that your savings keep up with (or overtake) inflation. Most importantly, they’ll make suggestions based on your overall financial plan and your savings goals.

Your IG Advisor has access to a huge range of investment options and the expertise to create a diversified portfolio that’s designed to maximize growth while keeping to the risk level that you’re comfortable with. Talk to your IG Advisor at Jeff Somers & Associates today to discuss investments that will protect your savings from inflation.

Author

Jeff Somers

CERTIFIED FINANCIAL PLANNER professional, RRC | Executive Financial Consultant

As a CERTIFIED FINANCIAL PLANNER professional since 2004 and frequent financial educator, Jeff specializes in tax-efficient portfolio management, providing sound advice and financial support to corporate or small business owners and retirees.

Written and published by IG Wealth Management as a general source of information only, believed to be accurate as of the date of publishing. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on up to date withholding rules and rates and on your specific circumstances from an IG Wealth Management Consultant. Trademarks, including IG Wealth Management and IG Private Wealth Management are owned by IGM Financial Inc. and licensed to its subsidiary corporations.

Share This Article On Your Channels